What Are Visa Borrower Loan Programs in California 2026?

You’ve worked in the US for three years on an H1-B visa. Your income is $120,000. Your credit score is 720. You have $50,000 saved for a down payment. Traditional lenders say “come back when you have a green card.” Meanwhile, you’re paying $3,500 monthly rent for a property you could buy for $2,800 monthly mortgage payments. Consider purchase loan options for buying.

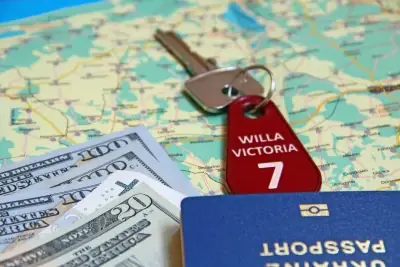

Visa borrower loan programs eliminate this citizenship barrier. These specialized programs recognize that visa holders often have stable employment, strong incomes, and excellent credit profiles that support homeownership despite temporary residency status.

California’s technology and professional sectors attract thousands of visa holders annually. Specialized lending programs serve this population with mortgage products designed for their unique documentation and status considerations.

Visa Borrower Loans - Non-Citizen Homeownership

Visa borrower loan programs provide mortgage access for temporary residents including work visa holders, students, and other non-permanent residents who maintain legal status and employment authorization.

The fundamental recognition involves understanding that visa status doesn’t indicate financial instability or inability to meet mortgage obligations, particularly for professional visa categories with strong employment prospects.

These programs adapt traditional mortgage underwriting to accommodate the documentation and timing considerations unique to visa holders while maintaining sound lending standards. Consider bridge loans in California for timing.

Specialized lenders understand visa categories, renewal processes, and employment authorization requirements that affect mortgage qualification for non-permanent residents. High-net-worth visa holders with significant liquid assets should explore aggressive asset depletion programs that maximize borrowing power based on portfolio value.

How Have Post-FHA Landscape Changes Affected Visa Borrower Loans?

Major policy changes occurred in May 2025 when FHA eliminated loan eligibility for non-permanent residents, significantly affecting visa holder mortgage options. Prior to this change, many visa holders used FHA loans in California with low down payments.

Conventional loans now represent the primary pathway for visa holder homeownership, requiring lenders who understand non-permanent resident qualification standards. Foreign nationals with U.S. employment may qualify through full documentation programs using work visa status and domestic income.

H1-B Visa Mortgage Programs

H1-B visa holders represent the largest segment of professional visa borrowers, typically working in technology, healthcare, engineering, and other specialized fields requiring advanced education.

H1-B qualification advantages include stable employment with established employers, competitive incomes, and often excellent credit profiles that support mortgage qualification.

Most H1-B holders work for large corporations that provide employment verification and income documentation that lenders recognize and accept for mortgage purposes.

Visa duration considerations involve balancing remaining H1-B term with mortgage qualification, though renewal history and employer support letters can address timing concerns.

These are general guidelines - exceptions exist. Give us a call because we can usually work around these guidelines with the right lender match.

How Does Technology Sector Concentration Affect H1-B Mortgage Programs?

California’s technology industry employs thousands of H1-B visa holders with competitive salaries that support mortgage qualification in expensive housing markets.

Silicon Valley lenders often specialize in H1-B borrower programs due to high concentrations of technology professionals seeking homeownership in the region.

E-2 Treaty Investor Visas

E-2 visa holders pursue entrepreneurial ventures in the United States, often with substantial investment capital and business income that supports mortgage qualification.

Investment verification requires documentation of E-2 business operations and income generation, which may involve more complex underwriting than traditional employee income.

E-2 visa holders often have international business experience and assets that can support mortgage qualification through alternative documentation programs.

Renewal patterns for E-2 visas depend on business success and continued investment, factors that lenders evaluate when assessing long-term mortgage viability.

What Documentation Do You Need?

E-2 visa holders may require specialized underwriting that evaluates business income rather than traditional employment, potentially utilizing non-QM loan programs.

Professional income documentation from CPA-prepared financial statements often supports E-2 mortgage qualification better than traditional W-2 employee verification.

Student Visa and OPT Programs

F1 student visa holders with Optional Practical Training (OPT) work authorization can qualify for mortgages if they demonstrate sufficient income and employment stability.

OPT employment must provide adequate income and employment documentation similar to traditional employees, though the temporary nature requires careful qualification analysis.

Students approaching graduation or those in STEM extension programs may have enhanced qualification opportunities due to extended work authorization periods.

Credit building during student years helps F1 visa holders establish the credit history necessary for mortgage qualification during OPT employment.

What Educational Institution Factors Affect Student Visa Mortgage Qualification?

Students from prestigious universities or those in high-demand fields may receive favorable consideration from lenders familiar with strong employment prospects.

Professional degree programs in medicine, law, engineering, and technology often provide pathways to stable employment that supports mortgage qualification.

L1 and TN Visa Categories

L1 intracompany transfer visa holders often have established employment relationships with multinational corporations that provide stability for mortgage qualification.

Corporate transfer documentation supports L1 visa mortgage applications through employer letters confirming transfer duration and renewal expectations.

TN visa holders from Canada and Mexico under NAFTA provisions typically qualify similarly to other professional visa categories with appropriate documentation.

Renewal history for both L1 and TN visas demonstrates employment stability that supports mortgage underwriting decisions about long-term payment capacity.

What Professional Documentation Standards Apply to L1 and TN Visas?

L1 and TN visa holders benefit from corporate employment structures that provide comprehensive income and employment verification supporting mortgage qualification.

Multinational corporation employment often includes benefits and compensation packages that strengthen overall borrower profiles for mortgage approval.

Alternative Credit and Documentation

Visa holders with limited US credit history may qualify through alternative credit documentation including utility payments, rent history, and international credit references.

Manual underwriting allows lenders to evaluate visa borrowers individually rather than relying solely on automated systems that may not accommodate unique circumstances.

International credit reports and banking relationships can supplement US credit history for visa borrowers with limited domestic credit files.

Alternative documentation programs including bank statement loans may serve visa holders with strong income but complex documentation needs.

What Credit Building Strategies Help Visa Holders Qualify for Mortgages?

Visa holders benefit from establishing US credit early through secured cards, authorized user accounts, and consistent utility and rent payment history.

Building credit relationships with banks that also offer mortgage services can enhance qualification prospects through existing banking relationships. Consider construction-to-permanent loans for building.